Professor Anezi Okoro, one of Nigeria’s best fiction writers, must wonder about the similarities between his protagonist, Wilson Tagbo, and Zenith Bank Chairman, Jim Ovia.

The UK Financial Services Authority and Fitch Ratings have both asked Zenith Bank to explain its role in fraudulent activities against Femi Otedola’s Seaforce Shipping.

At first, they fought in secret. But Otedola’s challenge to Zenith Bank’s alleged theft of his assets revealed the hidden side of Nigeria’s financial world.

This story is about deceit, manipulation, and financial fraud. Many other business people have suffered in silence under similar circumstances. But Otedola refused to give in to Zenith Bank’s bullying.

His defiance has shown the world the plight of many others who have been robbed of their wealth by unscrupulous organizations.

Otedola’s bold stand against Zenith Bank is a turning point. It’s a call for justice in a dark place. His decision to stand firm and reclaim his rightful assets from the banking giant signals a potential crusade against the culture of exploitation in power.

Otedola said Zenith Bank used his company’s account to trade in 2011 without his knowledge or consent.

The police are investigating these and other allegations. They are trying to resolve the issues peacefully.

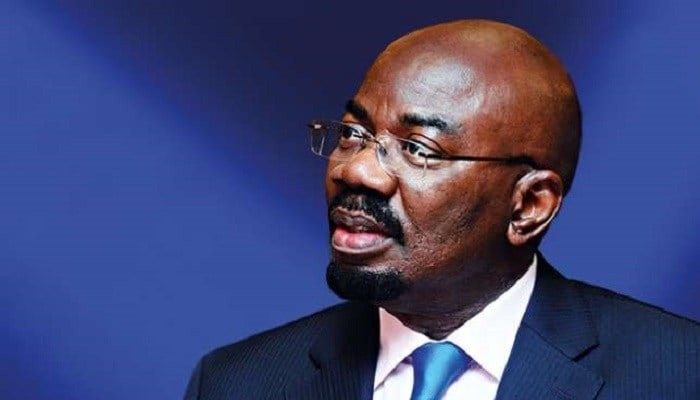

The Cable has contacted Ovia and Zenith Bank for comments.

Seaforce Shipping’s account was used for trading even though it had not been operated since 2010. According to his petition to the police, Otedola was not aware of this.

Otedola said Seaforce never took a loan from Zenith Bank. But the account was used to trade billions of naira.

Zenith Bank needed to provide the documents they requested, including loan offer letters.

When a whistleblower told him, Otedola only found out about the suspicious activity 13 years later.

When he confronted the bank, they apologized.

Otedola showed a letter from March 19, 2018, written by Zenith Bank to Shofolawe-Bakare & Co., Seaforce’s auditors. The letter stated a debt of only N2,278,420 on the same account. This is different from the N5 billion recorded in the bank statement seen by TheCable.

On the day the letter was written, the bank statement showed a debt of N2.9 billion, not N2 million.

Over N16 billion was recorded against Seaforce’s account from 2011 to 2024.

Otedola asked who made the payments to reduce the debt from ₦16,927,628,581.84 to ₦11,010,924,522.71. He was not aware of the transactions.

Seaforce now has a debt of N5.9 billion, with interest charges making up a large part.

The police have questioned a bank official.

Meanwhile, Zenon, Seaforce, Luzon Oil and Gas, Garment Care Limited, and Otedola have secured an injunction against Zenith Bank, Quantum Zenith Securities and Investment, Veritas Registrar, and Central Securities Clearing System, preventing them from trading with shares or paying dividends.

This injunction lasts until the hearing on the motion for an injunction.

Discuss

More news

Discuss

More news